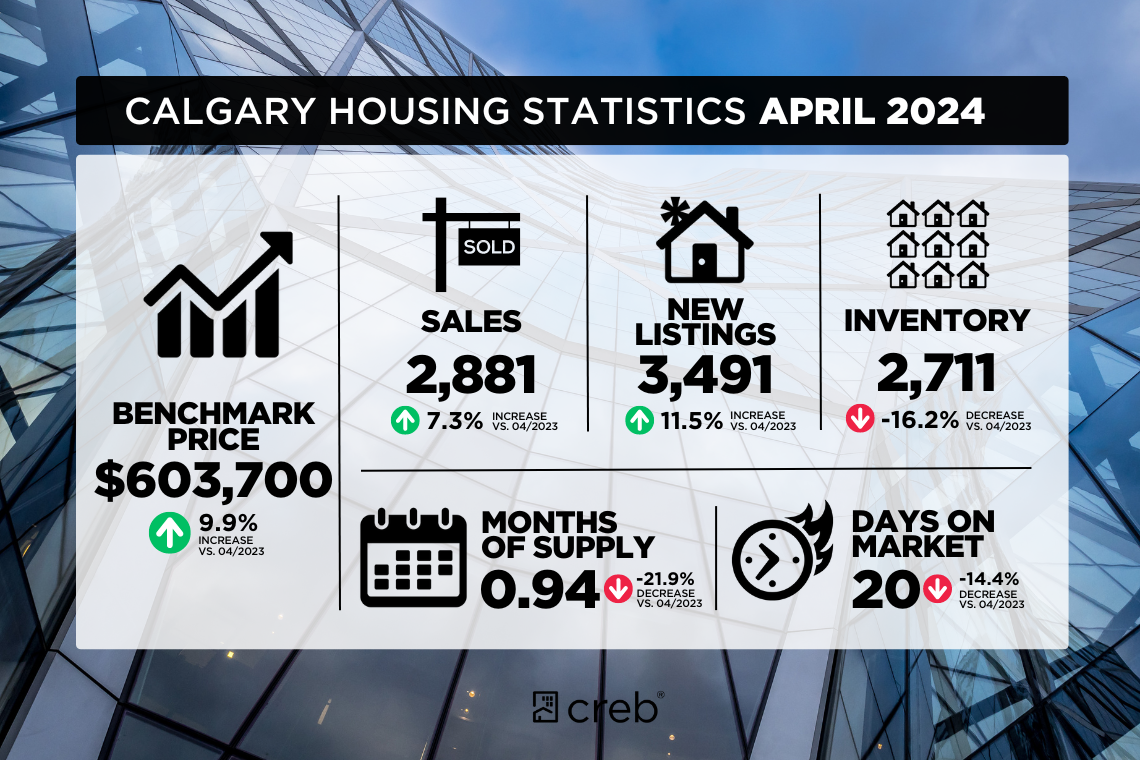

Sales in April rose by seven percent compared to last year, to 2,881 units. While the pace of growth did ease compared to earlier in the year, sales remain 37 percent higher than long-term trends for the month. Much of the growth in sales has occurred for relatively more affordable, higher-density products.

At the same time, there were 3,491 new listings in April, an 11 percent gain over last year but only three percent higher than long-term trends. The rise in new listings compared to sales prevented further deterioration of the inventory situation. However, with 2,711 units in inventory, levels are 16 percent below last year and half of what is traditionally seen in April.

“While supply levels are still declining, much of the decline has been driven by lower-priced homes," said Ann-Marie Lurie, Chief Economist at CREB®. Homes priced below $500,000 have reported a 29 percent decline. Meanwhile, we are seeing supply growth in homes priced above $700,000. Persistently high-interest rates are driving demand toward more affordable products in the market and, simultaneously, driving listing growth for higher-priced properties.”

With a sales-to-new-listings ratio of 83 percent and a months of supply of less than one month, conditions continue to favour the seller, driving further price gains in the market. In April, the unadjusted total residential benchmark price reached $603,700, a one percent gain over last month and nearly 10 percent higher than last year's levels. Price gains occurred across all property types and districts of the city. The strongest price growth occurred in the more affordable districts of the city.

Detached

Detached home sales rose by one percent in April compared to last year. Sales gains in the higher price ranges offset the steep decline for homes priced below $600,000, which is related to the lack of listings in the lower price ranges. While detached new listings did report a year-over-year gain of 10 percent, detached homes priced below $600,000 saw new listings decline by 34 percent.

Adjustments in sales and inventory levels caused the months of supply to fall further this month. The less than one-month supply reflects a market favouring the seller, driving further price growth. In April, the unadjusted benchmark price reached $749,000, over one percent higher than last month and 13 percent higher than April 2023 levels. Year-over-year gains were the highest in the city's most affordable districts.

Semi-Detached

Sales activity continued to rise in April, contributing to the nearly 18 percent year-to-date growth in sales. The growth in sales was partly due to gains in new listings. However, the growth in new listings did little to change the low inventory situation, as the months of supply remained below one month for the second month.

The persistently tight market conditions have caused further price gains. In April, the unadjusted benchmark price reached $668,400, nearly two percent higher than last month and 13 percent higher than levels reported last year. Year-over-year price gains ranged from a high of 23 percent in the East district to a low of 10 percent in the City Centre.

Row

Row home sales continued to improve in April, contributing to the 19 percent year-to-date gain. At the same time, new listings have improved by 16 percent so far this year. The gains in new listings did little to change the low inventory situation due to sales activity. This has kept the sales-to-new-listings ratio high at 93 percent and the inventory months below one month for the fourth consecutive month.

The persistently tight conditions, especially in the lower price ranges, drive further price growth for row homes. In April, the unadjusted benchmark price reached $458,100, two percent higher than last month and 20 percent higher than levels reported last year. Both monthly and year-over-year gains were the highest in the most affordable districts of the North East and East, where resale row homes are still priced below $400,000.

Apartment Condominium

Sales in April reached 822 units, contributing to year-to-date sales of 2,761 units, a 24 percent gain. Apartment condominium sales have risen more than any other property type and now represent nearly 30 percent of all resale activity. This, in part, has been possible due to the rise in new listings. April reported 1,050 new listings, helping support a monthly gain in inventory levels in line with seasonal expectations. However, inventory levels remain nearly 13 percent lower than last year’s and are 35 percent below long-term trends.

Like other property types, year-over-year supply declines are driven by the lower-priced segments of the market, which for apartment condominiums is units priced below $300,000. Persistent sellers’ market conditions in the lower price ranges drive further price growth. In April, the unadjusted benchmark price reached $346,200 a month, a gain of over two percent and nearly 18 percent higher than last April. Year-over-year price growth ranged from over 30 percent in the North East and East districts to a low of 13 percent in the City Centre.

At the same time, there were 3,491 new listings in April, an 11 percent gain over last year but only three percent higher than long-term trends. The rise in new listings compared to sales prevented further deterioration of the inventory situation. However, with 2,711 units in inventory, levels are 16 percent below last year and half of what is traditionally seen in April.

“While supply levels are still declining, much of the decline has been driven by lower-priced homes," said Ann-Marie Lurie, Chief Economist at CREB®. Homes priced below $500,000 have reported a 29 percent decline. Meanwhile, we are seeing supply growth in homes priced above $700,000. Persistently high-interest rates are driving demand toward more affordable products in the market and, simultaneously, driving listing growth for higher-priced properties.”

With a sales-to-new-listings ratio of 83 percent and a months of supply of less than one month, conditions continue to favour the seller, driving further price gains in the market. In April, the unadjusted total residential benchmark price reached $603,700, a one percent gain over last month and nearly 10 percent higher than last year's levels. Price gains occurred across all property types and districts of the city. The strongest price growth occurred in the more affordable districts of the city.

Detached

Detached home sales rose by one percent in April compared to last year. Sales gains in the higher price ranges offset the steep decline for homes priced below $600,000, which is related to the lack of listings in the lower price ranges. While detached new listings did report a year-over-year gain of 10 percent, detached homes priced below $600,000 saw new listings decline by 34 percent.

Adjustments in sales and inventory levels caused the months of supply to fall further this month. The less than one-month supply reflects a market favouring the seller, driving further price growth. In April, the unadjusted benchmark price reached $749,000, over one percent higher than last month and 13 percent higher than April 2023 levels. Year-over-year gains were the highest in the city's most affordable districts.

Semi-Detached

Sales activity continued to rise in April, contributing to the nearly 18 percent year-to-date growth in sales. The growth in sales was partly due to gains in new listings. However, the growth in new listings did little to change the low inventory situation, as the months of supply remained below one month for the second month.

The persistently tight market conditions have caused further price gains. In April, the unadjusted benchmark price reached $668,400, nearly two percent higher than last month and 13 percent higher than levels reported last year. Year-over-year price gains ranged from a high of 23 percent in the East district to a low of 10 percent in the City Centre.

Row

Row home sales continued to improve in April, contributing to the 19 percent year-to-date gain. At the same time, new listings have improved by 16 percent so far this year. The gains in new listings did little to change the low inventory situation due to sales activity. This has kept the sales-to-new-listings ratio high at 93 percent and the inventory months below one month for the fourth consecutive month.

The persistently tight conditions, especially in the lower price ranges, drive further price growth for row homes. In April, the unadjusted benchmark price reached $458,100, two percent higher than last month and 20 percent higher than levels reported last year. Both monthly and year-over-year gains were the highest in the most affordable districts of the North East and East, where resale row homes are still priced below $400,000.

Apartment Condominium

Sales in April reached 822 units, contributing to year-to-date sales of 2,761 units, a 24 percent gain. Apartment condominium sales have risen more than any other property type and now represent nearly 30 percent of all resale activity. This, in part, has been possible due to the rise in new listings. April reported 1,050 new listings, helping support a monthly gain in inventory levels in line with seasonal expectations. However, inventory levels remain nearly 13 percent lower than last year’s and are 35 percent below long-term trends.

Like other property types, year-over-year supply declines are driven by the lower-priced segments of the market, which for apartment condominiums is units priced below $300,000. Persistent sellers’ market conditions in the lower price ranges drive further price growth. In April, the unadjusted benchmark price reached $346,200 a month, a gain of over two percent and nearly 18 percent higher than last April. Year-over-year price growth ranged from over 30 percent in the North East and East districts to a low of 13 percent in the City Centre.

Source: CREB