For a lot of millennials, home ownership hasn’t felt impossible — just distant. Something that lives somewhere between rising rents, student loans, lifestyle flexibility, and the very real feeling that the rules our parents played by don’t apply to us anymore.

That’s why when I talk to millennials about buying a home, I don’t lead with pressure. I lead with honesty, choice, and realism. Because this generation doesn’t need convincing — they need clarity.

Millennials value autonomy, transparency, and emotional security. What I see over and over again is that people aren’t delaying home buying because they don’t care — they’re delaying because they’re thoughtful. Many of us watched the 2008 financial crisis unfold during our formative years. We entered the workforce during uncertainty. We learned early that risk deserves respect.

So fear-based messaging and urgency tactics don’t land. What does land is context, information, and control.

That’s why the language we use around home buying matters more than ever.

Home ownership doesn’t need to be framed as a milestone you’re supposed to hit by a certain age. For most millennials, it makes far more sense to think of it as a tool — a way to stabilize monthly housing costs, build equity instead of absorbing rent increases, and create a living space that actually reflects your values and lifestyle. When ownership is positioned as flexible and customizable, it suddenly feels a lot more approachable. Markets will always fluctuate, but time in the market and finding the right home is more important than timing the market.

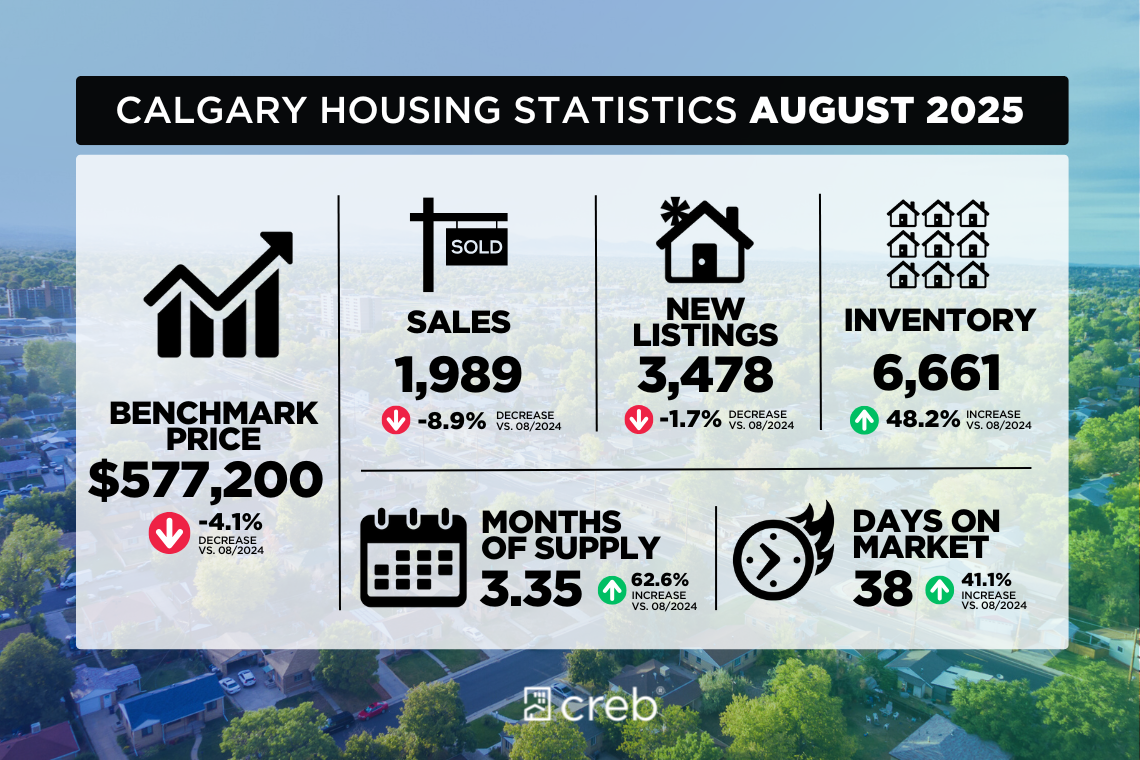

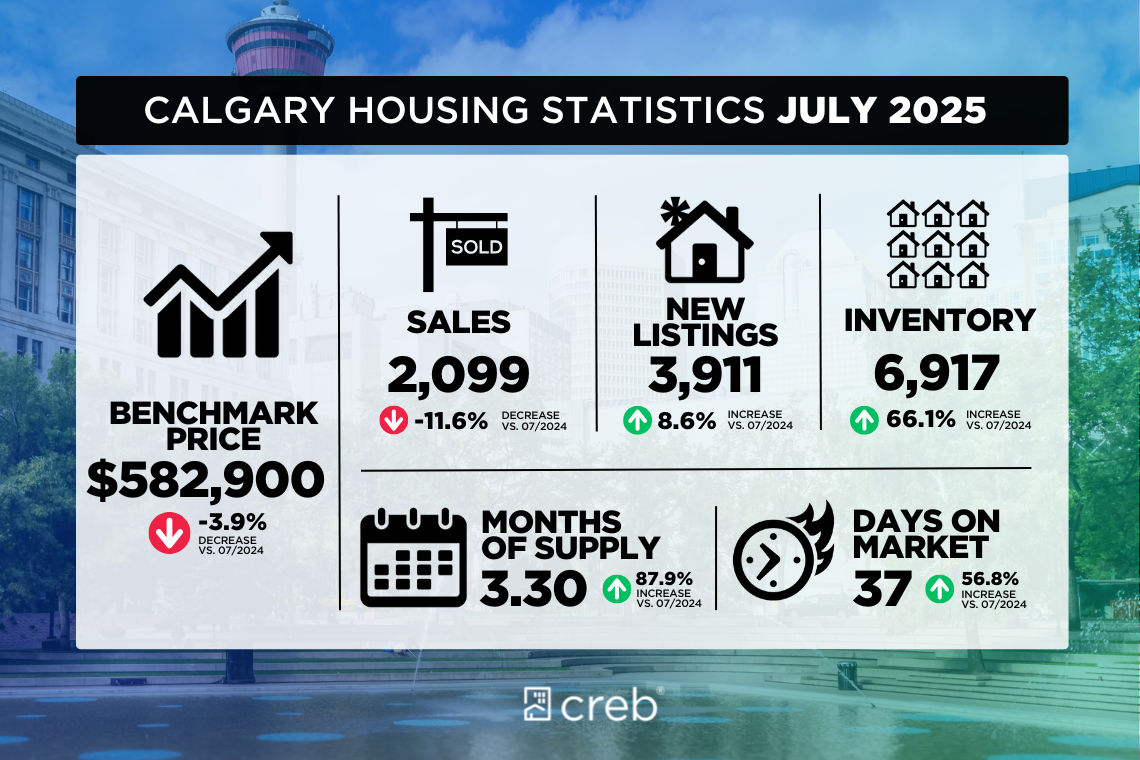

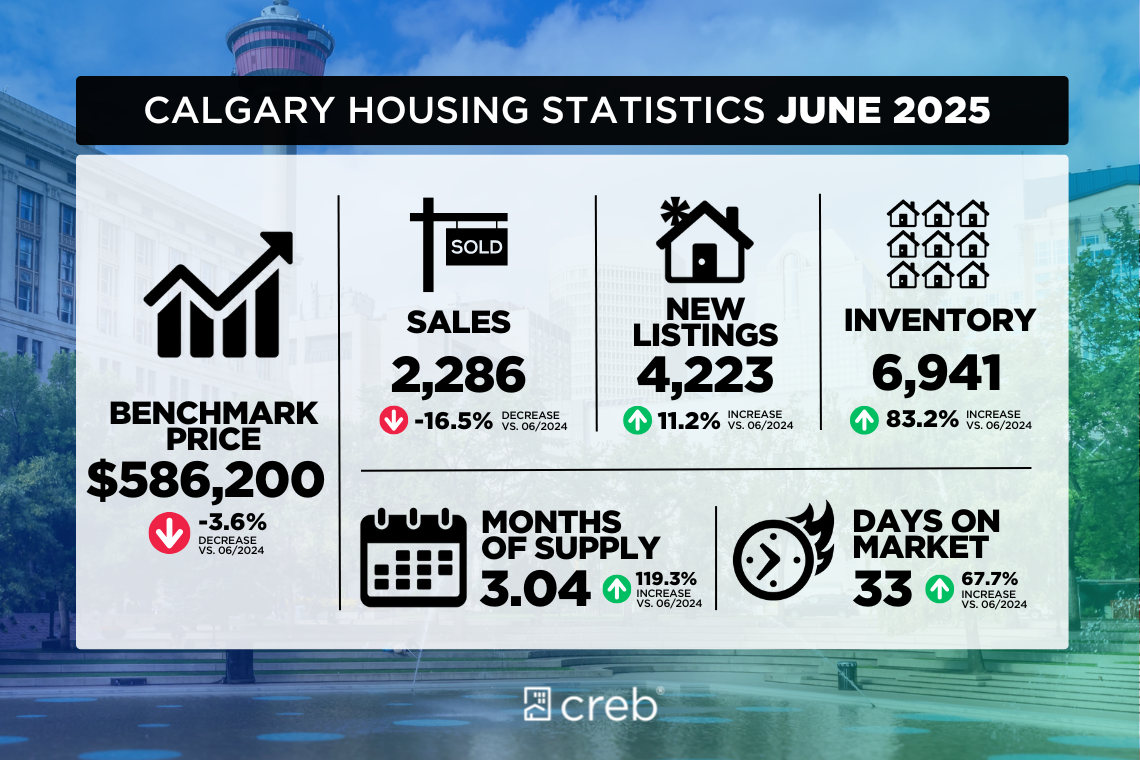

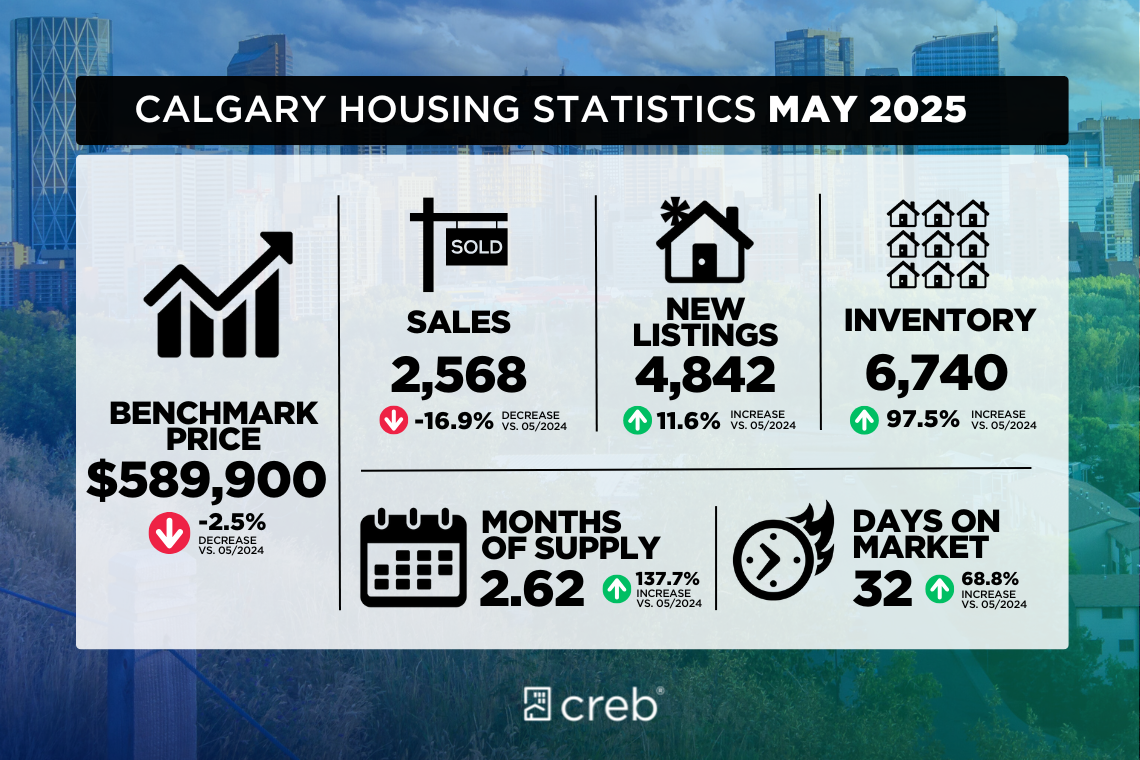

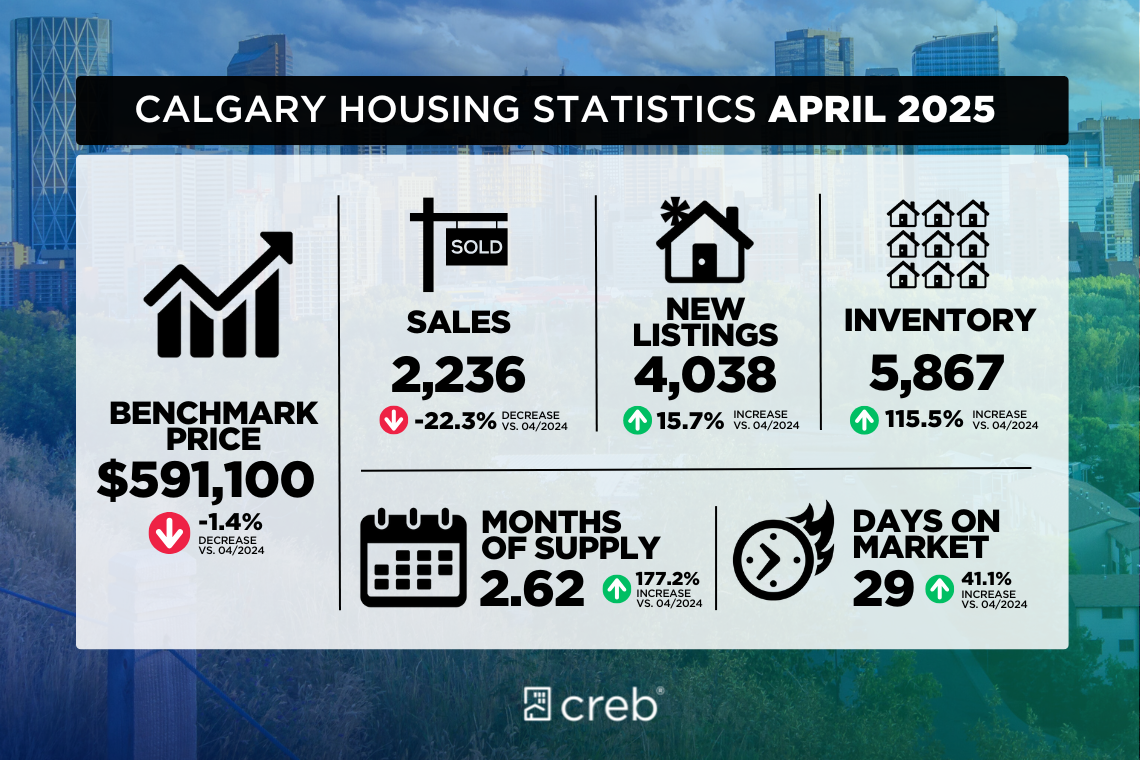

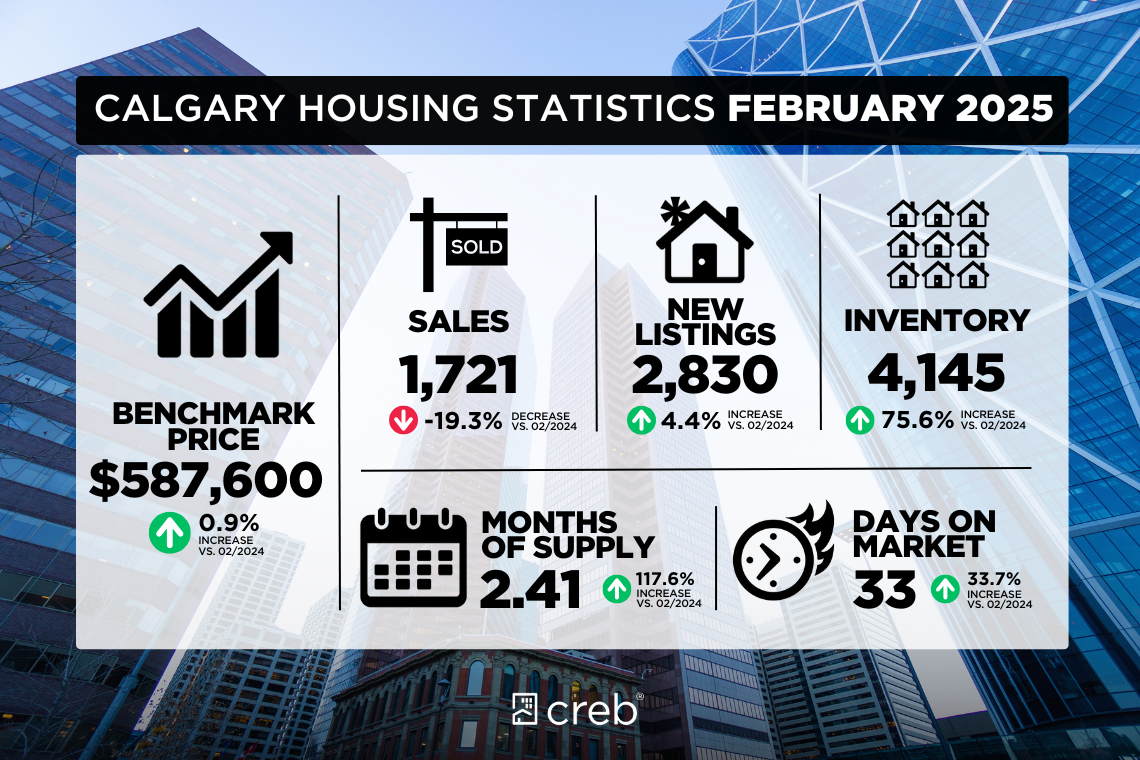

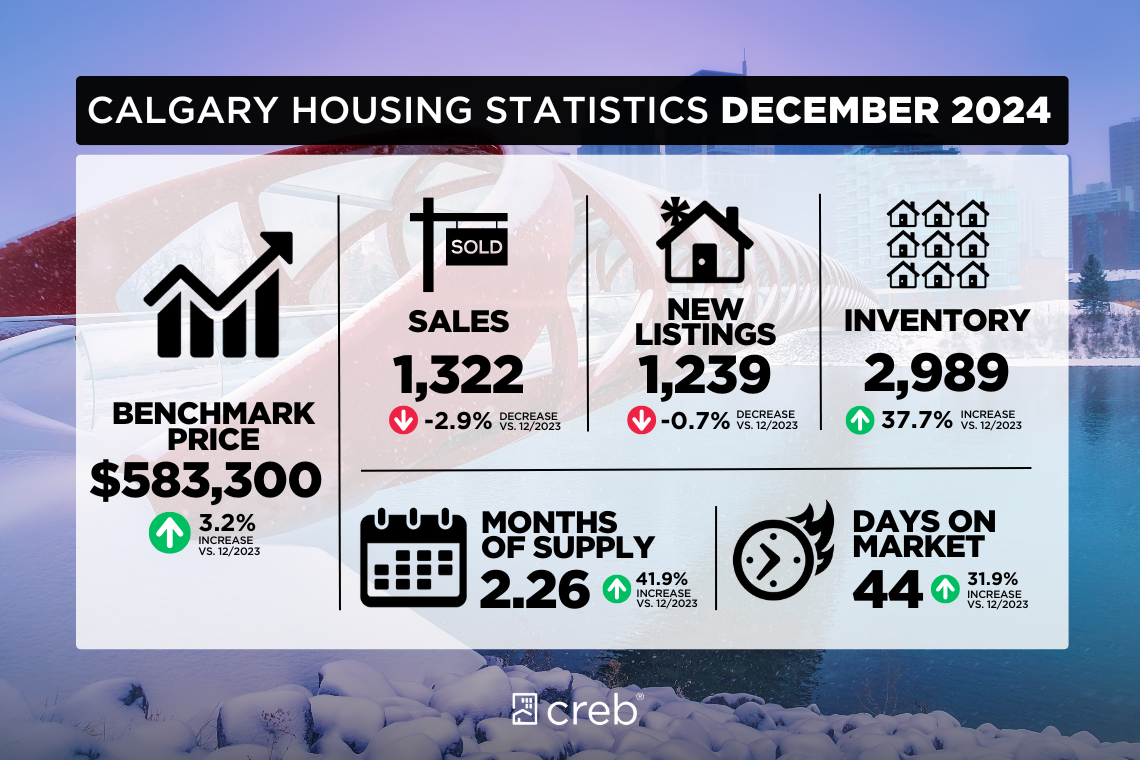

Market conditions also matter in how this story is told. Right now, in many parts of Canada, we’re seeing a real shift toward more buyer-friendly conditions. Inventory has improved. Negotiation power is back. Price growth has cooled. That means more choice, more leverage, and more time to make intentional decisions — which, honestly, suits millennials perfectly. Researching, comparing, and thinking things through isn’t a weakness. It’s a strength.

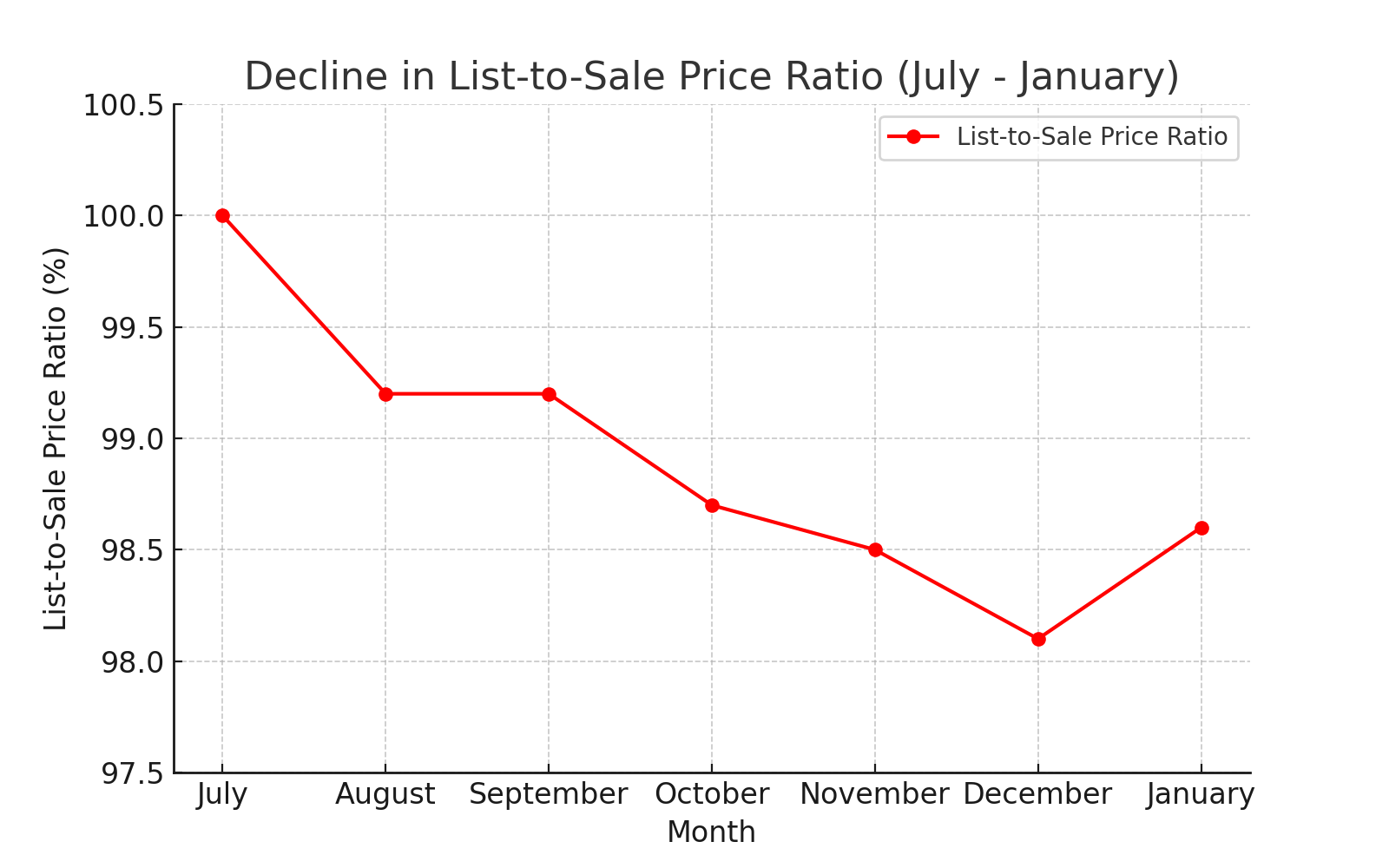

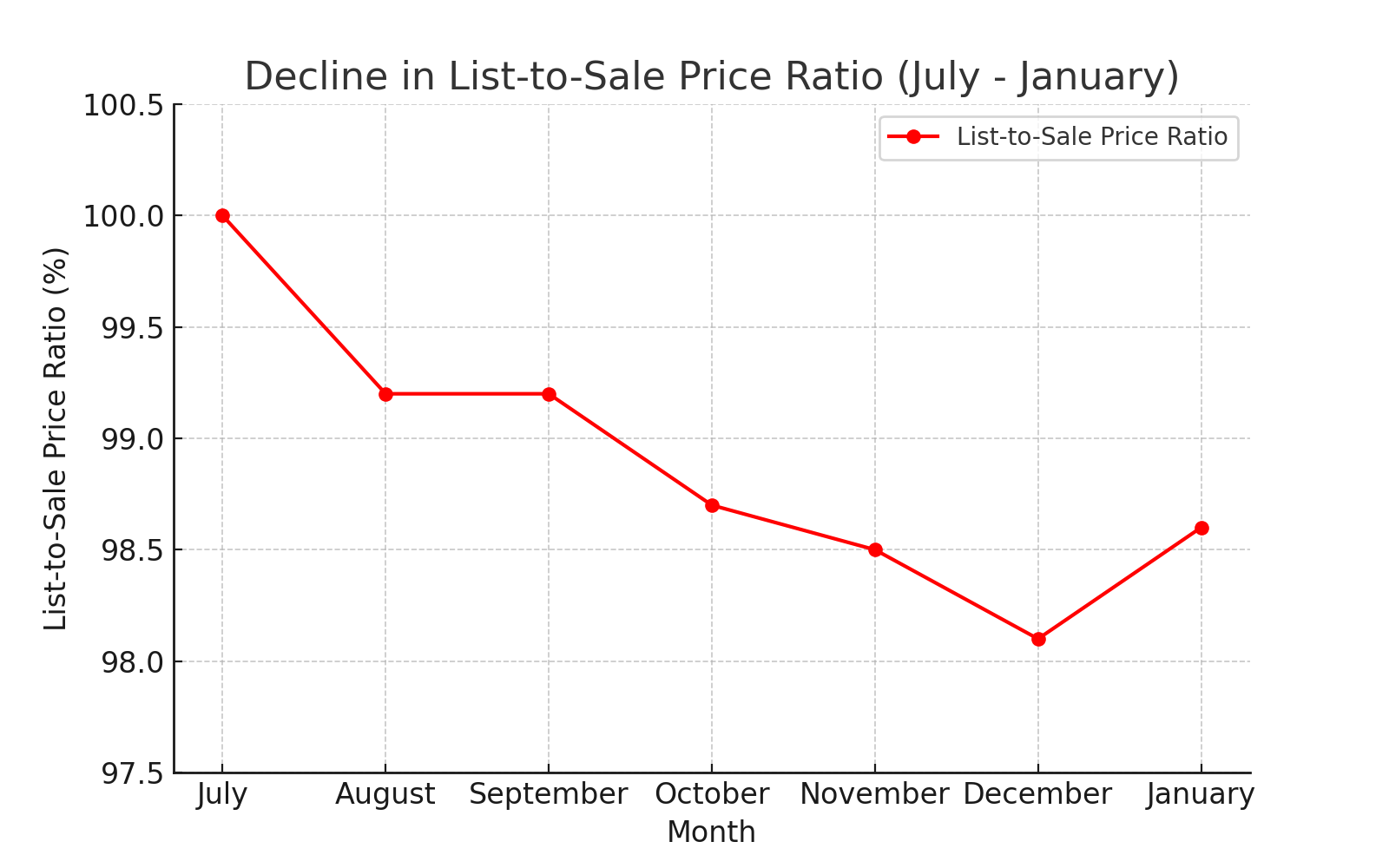

Interest rates are another topic that needs better framing. Yes, rates are lower than their recent peak — but more importantly, they’re stable and financeable. A lot of millennials assume today’s rates are historically high, when in reality they’re still well below what buyers saw in the 1980s and 1990s. What matters more is how rates interact with pricing, income, and flexibility. In a softer market, stable rates can actually create entry points that simply don’t exist during overheated cycles.

In Canada, interest rates are not set by individual cities or provinces. They are influenced at the national level by the Bank of Canada, which sets the policy interest rate based on conditions across the entire Canadian economy. This rate acts as a benchmark that lenders use when determining mortgage rates, lines of credit, and other borrowing costs. While banks ultimately set their own rates, they closely follow the Bank of Canada’s decisions.

When the Bank of Canada raises interest rates, it is usually responding to inflationary pressure — meaning the overall cost of goods and services is rising too quickly. Higher borrowing costs reduce how much consumers can afford to borrow, which in turn slows spending across the economy. In real estate, this often translates to reduced buyer affordability, fewer bidding wars, and more balanced or downward pressure on home prices.

On the other hand, when the Bank of Canada lowers interest rates, it is typically trying to stimulate economic activity. Lower rates make borrowing more affordable, encouraging consumers and businesses to spend and invest. In housing markets, this can support buyer demand, improve affordability, and help stabilize or revive real estate activity during slower economic periods.

It’s important to understand that interest rate changes are not designed to control real estate alone. Housing is just one part of a much larger economic system that includes employment, wages, consumer spending, and inflation. This is why a city or province may experience different market conditions than the national average, even though interest rates apply uniformly across the country.

Psychologically, millennials are also far more engaged when buying is framed as adaptable. First homes don’t have to be forever homes. They’re stepping stones. Chapters, not conclusions. Conversations around starter homes, co-ownership, rental potential, and future mobility help remove the fear of being “stuck” in one decision.

Most importantly, millennials want to feel respected in the conversation. They want to be informed, not sold to. They want advisors who acknowledge affordability concerns without minimizing them, and who are honest about trade-offs, timing, and readiness.

Home ownership becomes approachable when it’s positioned as one of several valid paths to financial and personal stability. In today’s changing Canadian market — with more balance returning and buyer-friendly conditions emerging — the opportunity isn’t about convincing you to buy its giving you the confidence to make informed decisions.

And for a generation that values intentional living above all else, that makes all the difference.