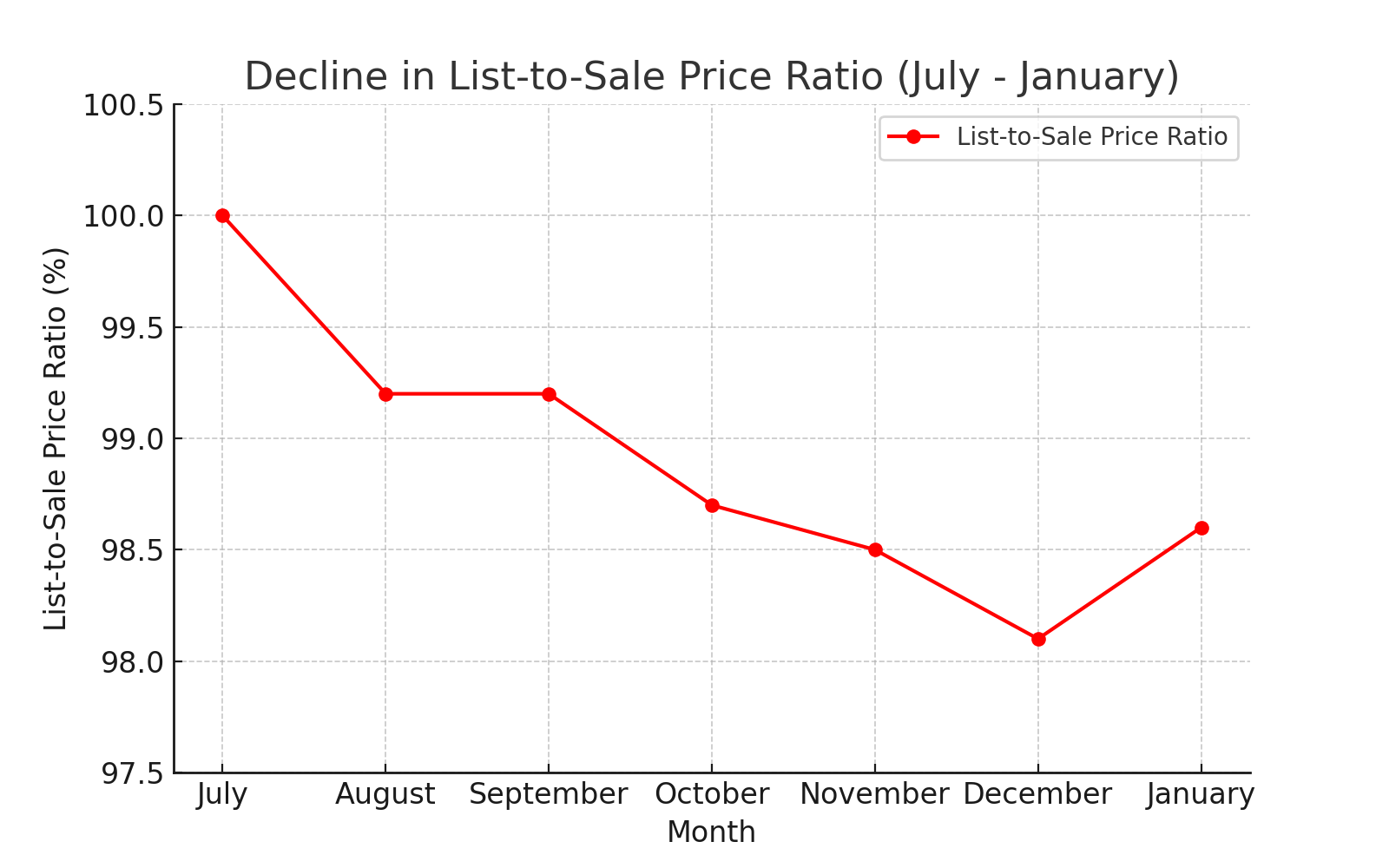

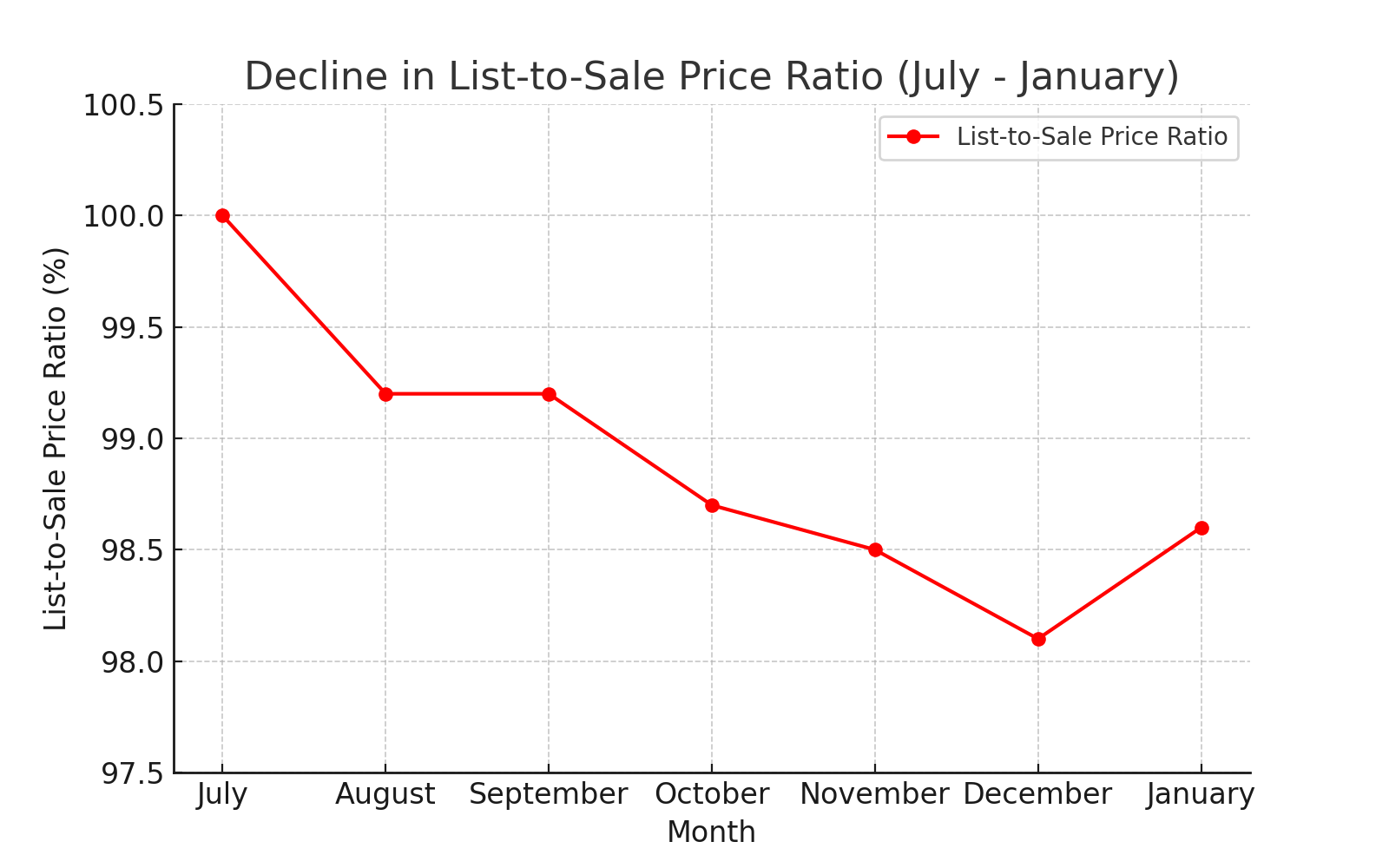

As we move into the winter months, I’m seeing our market shift in a way that’s very typical for this time of year. Activity has slowed slightly across the board — sales, new listings, and inventory have all pulled back compared to October. In November, we recorded 1,553 sales and 2,251 new listings, which pushed the sales-to-new-listings ratio to 69%. While this helped ease some inventory pressure, we still ended the month with 5,581 active listings — which is 28% higher than last year and about 15% higher than what we usually see in November.

Over the past few months, supply has consistently been sitting above typical levels, mostly due to growth in higher-density housing — our row and apartment segments. Much of this additional choice is connected to Calgary’s strong new-build sector, where some properties eventually make their way to the resale market, especially late in the year. Because of this, conditions in the apartment market — and to a lesser extent the row market — have leaned more toward a buyer’s market. In contrast, the detached and semi-detached markets remain relatively balanced, aside from a few pockets experiencing heavier competition from new construction.

Not surprisingly, this extra supply is having the biggest impact on pricing in the apartment and row sectors. Year-over-year, apartment prices are down 7% and row prices are down 6%. Detached home prices have eased by about 2%compared to last November, but they still sit above last year when we look at year-to-date numbers. Our total residential benchmark price for November came in at $559,000, nearly 5% lower than the same month last year.

Detached Market

In the detached segment, November saw 823 sales, just slightly below last year and still within normal activity for the month. New listings did pull back, which helped soften inventory compared to October, but we’re still sitting well above last year’s very low supply levels. Overall, supply is now more aligned with long-term norms, and months of supply continues to hover around three months — a sign of balanced conditions.

Prices did trend down month-over-month due to seasonal patterns. The detached benchmark for November came in at $733,000, nearly 2% lower than last November. But when we step back and look at the year-to-date picture, detached prices remain 1% higher than they were at this time last year. The majority of downward pressure is concentrated in the North East, North, and East districts, where competition from new builds is especially strong.

Semi-Detached Market

Semi-detached sales this month were consistent with last year and still well above long-term averages. However, with new listings higher than typical, inventory climbed to its highest November level in five years. Months of supply has now stayed above three months for three consecutive periods, bringing this segment into more balanced territory.

The benchmark price for semi-detached homes eased slightly this month to $671,700, but remained stable year-over-year. So far this year, this segment has shown the strongest price growth at nearly 3%, with the City Centre leading the way with a 4% increase, helping offset small declines in the North district.

Row Homes

Row home sales eased to 257 units this month — still above long-term trends, but lower than last year’s record-high November. What’s standing out here is supply: even though new listings were similar to last year and inventory followed a normal seasonal dip, we’re still sitting at the highest November inventory levels since 2018. This extra supply has kept months of supply slightly elevated for several months now and is placing pressure on pricing.

The row benchmark price for November was $424,400, down month-over-month and over 6% lower than last year. Year-to-date, row prices have dipped nearly 2%, with some of that decline driven by ongoing supply gains rather than just seasonal slowdown.

Apartment Condominiums

The apartment market continues to face the most significant supply challenges. November sales dropped to long-term norms, but new listings stayed elevated, and inventory reached a record high for the month of November. Months of supply is now hovering close to six months, and has been above four months since summer — firmly placing this segment in buyer-friendly conditions.

As a result, pricing has been adjusting for several months. November’s apartment benchmark price was $309,300, which is 7% lower than last year. Year-to-date, prices are down just over 2%, with the North East experiencing the largest pullback at nearly 5%. The only district where prices held flat this year was the West.

Regional Highlights

Airdrie

Airdrie is following typical seasonal patterns with sales, new listings, and inventory all easing month-over-month. Both sales and listings remained in line with long-term norms, but earlier inventory gains have carried through, leaving supply elevated for November. A growing number of newer homes hitting the resale market is part of the reason behind this. Prices have felt some of this pressure, and year-to-date detached benchmark prices are now sitting nearly 1% below last year — though still far above where they were several years ago.

Cochrane

Cochrane saw a seasonal pullback in new listings this month, but even with that, November still reached a record high for new listings. Sales remain strong for November, but not at a level that could offset the rise in supply. Inventory is now at its highest November point since 2018. Some of this activity is tied to new homes being listed on the resale market. Despite the recent supply gains, year-to-date detached prices remain almost 2% higher than last year.

Okotoks

Okotoks stood out this month with sales actually increasing compared to last month and holding steady with last year. This is likely connected to higher new-listing activity in both October and November, giving buyers more options. While inventory has trended up recently, it still sits well below long-term averages, keeping market conditions relatively tight. Prices have seen some minor seasonal adjustments, but overall, year-to-date prices across every property type remain higher than last year.